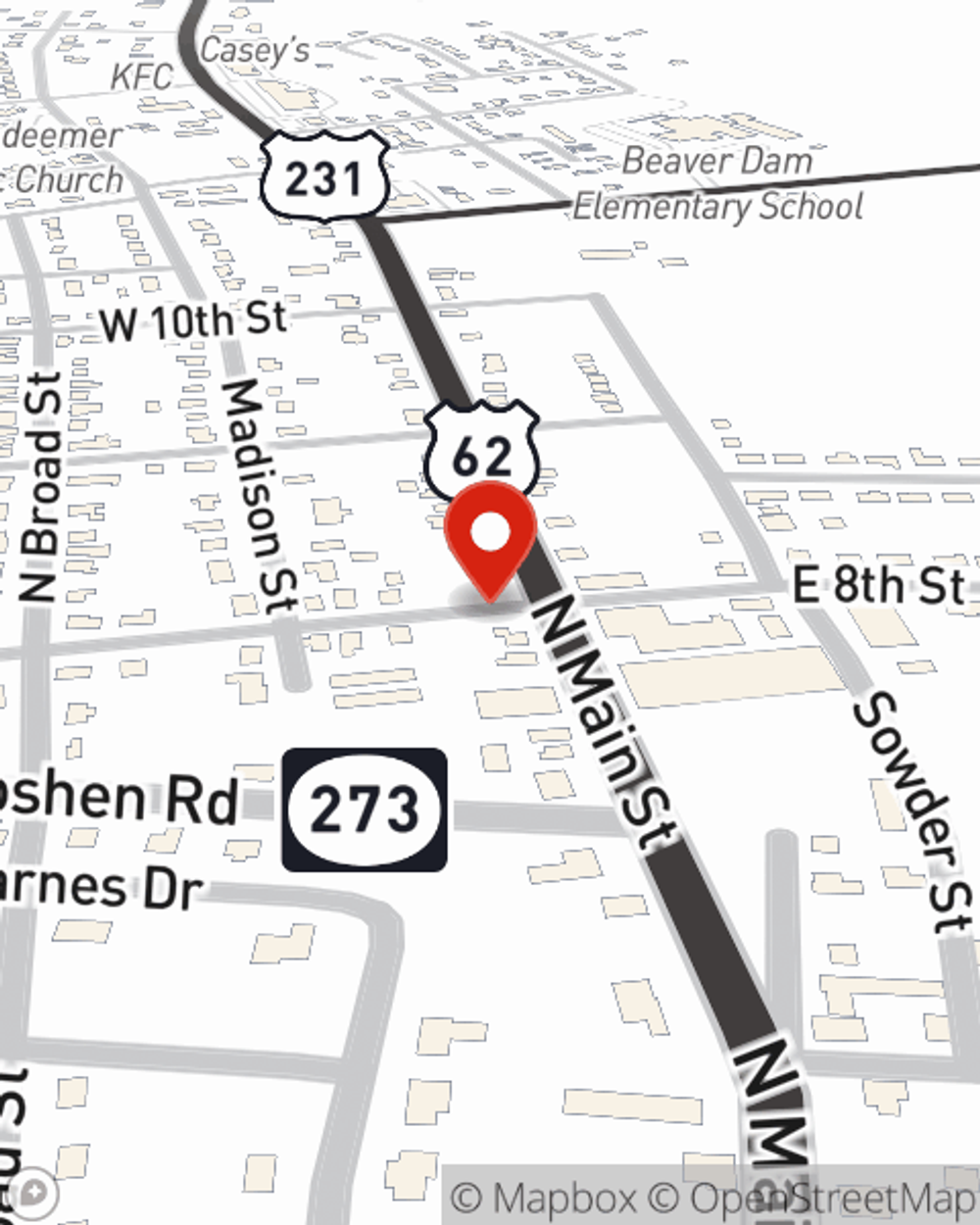

Life Insurance in and around Beaver Dam

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

Can you guess the price of a typical funeral? Most people aren't aware that the midpoint for the cost of a funeral today is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the ones you leave behind cannot manage that expense, they may end up with large debts after your passing. With a life insurance policy from State Farm, your family can maintain their quality of life, even without your income. Whether it keeps paying for your home, pays for college or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

Coverage for your loved ones' sake

What are you waiting for?

State Farm Can Help You Rest Easy

Fortunately, State Farm offers many coverage options that can be personalized to match the needs of your family members and their unique situation. Agent Claude Taylor has the deep commitment and service you're looking for to help you settle upon a policy which can assist your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to find out what a company that processes nearly forty thousand claims each day can do for you? Call or email State Farm Agent Claude Taylor today.

Have More Questions About Life Insurance?

Call Claude at (270) 274-3322 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Claude Taylor

State Farm® Insurance AgentSimple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.